19 January 2022

Singaporeans prepared to live with COVID-19, start taking back control of their financial, physical, and mental health

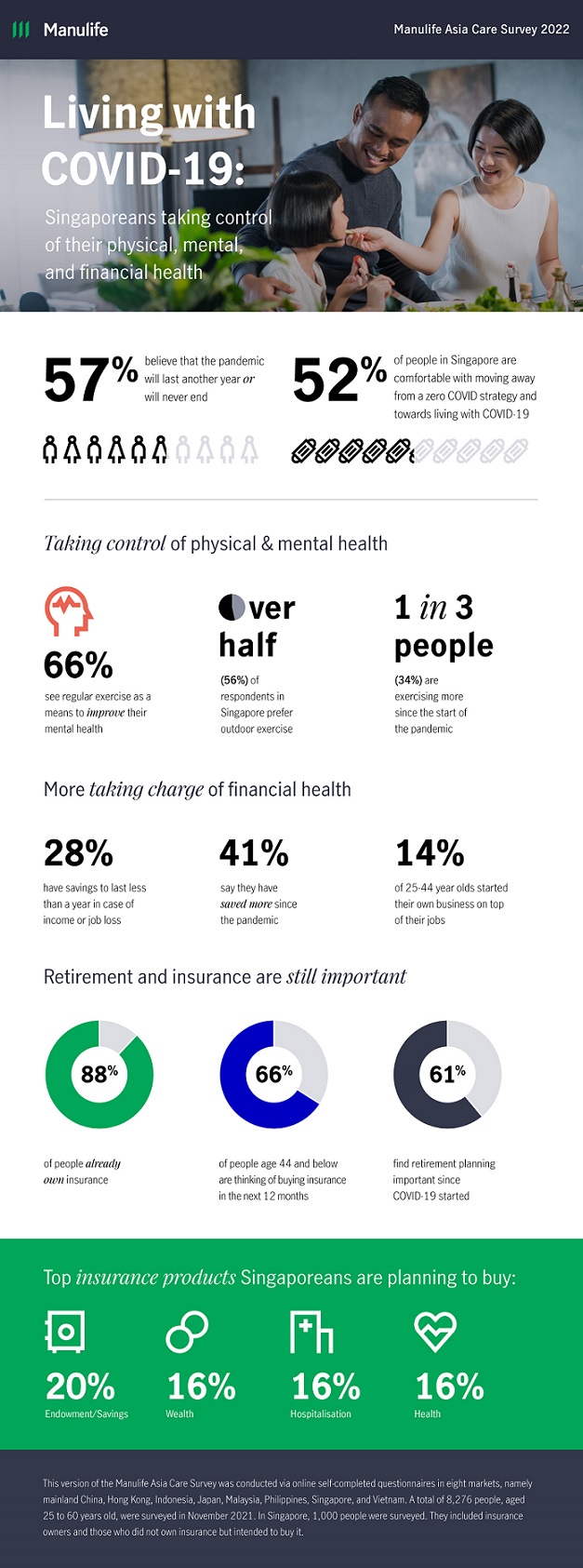

- One in two Singaporeans accepts COVID-19 is here to stay and expects restrictions and measures to last for at least another year

- Nearly half of Singaporeans saved more since the pandemic, yet only 28% have enough savings to last for more than a year in case of job or income loss

- Work is the top cause of burnout in Singapore, however only one in two are comfortable seeking professional mental health advice

- Demand for new insurance continues to be high, with endowment/savings and hospitalisation plans being top potential buys

SINGAPORE – More than two years into the pandemic, Singaporeans have accepted that COVID-19 is here to stay, however they remain concerned at the pace of economic recovery, income security, and about their mental health. These concerns have propelled them to take charge of their financial well-being, with more Singaporeans starting their own businesses, in addition to their full or part-time jobs, and more also intending to buy new insurance over the next year. These are some of the findings from the latest “Manulife Asia Care Survey”[1].

Living with COVID-19: financial security and mental health among top concerns

While more than a quarter (29%) of Singaporeans are concerned about the length of the economic recovery, they are less concerned than their counterparts across the Asia region (33%). However, Singaporeans are more concerned about job or income loss (19%) than consumers elsewhere in Asia (16%). Singaporeans are also worried about worsening mental health, with just 53% saying their mental health is good - higher than Hong Kong (47%) and Japan (43%), but below the region as a whole (64%).

Among the Singapore respondents surveyed, 57% believe the pandemic will last another 12 months or will never end. Half (50%) expect COVID-19 measures, such as social distancing and mask-wearing, to remain in place for at least another year. However, the situation is met with acceptance and more than half (52%) show a readiness to live alongside COVID-19 and get on with life.

“Singaporeans have gained resilience after more than two years of living through a pandemic. Our survey shows that while people may feel that parts of their lives have deteriorated, they have also made major adjustments in other areas to cope and take back control,” said Khoo Kah Siang, Chief Executive Officer at Manulife Singapore. “Choosing to improve their financial habits and actively manage their overall well-being, Singaporeans are looking for more information and support to eliminate uncertainties in their lives. Life and health insurers can fill this gap by helping consumers address their changing life concerns, financial and coverage needs.”

Singaporeans are focused on taking charge of their financial health this year

While incomes in Singapore held up better during the pandemic than the rest in the region, where 44% in Asia have seen a decline, a third (34%) of Singaporeans said their income has fallen. 30% had cut back on unnecessary or big-ticket expenses to alleviate the impact of COVID-19 and mitigate further financial risks. One in five (20%) have opted to invest more and 10% are planning for retirement.

This financial risk is reflected in Singaporeans’ level of savings. In case of loss of work or income, just 28% of Singaporeans have enough savings to last for more than a year, well below the regional average (36%). However, despite this, 41% Singaporeans say that they have managed to save more since the pandemic.

Another interesting finding is the number of Singaporeans who have started their own business on top of their full or part time jobs. This trend is especially prominent among the younger segment of Singaporeans where there is a noticeable trend in increased interest in entrepreneurship. 14% of Singaporeans aged 25-44 have started their own business on top of their full and part time jobs.

The survey illustrates Singaporeans’ desire to stay in control of their health and financial affairs. Of those surveyed, 88% currently own insurance, above the regional average (75%). The most popular insurance products in Singapore include hospitalisation (55%), life protection (50%) and critical illness (49%) – with all areas ranking above the regional average. Among the 58% looking to purchase new insurance plans in the next 12 months, endowment/savings insurance (20%), hospitalisation cover (16%) wealth / investment-linked insurance (16%), and health (16%) are top of the list in Singapore.

Filling the information gap will help Singaporeans make better financial decisions. Affordability and easily digestible product information is crucial when it comes to buying insurance. 38% cited pricing as the main barrier to purchase, followed by 28% who found insurance product information too complicated to understand. Looking ahead into the next decade, 65% indicated that they would buy insurance from online channels such as insurance comparison websites (26%) and insurance company websites (20%).

Singaporeans see physical exercise as a way to improve mental health; less willing to seek professional help on mental well-being

Work is the leading cause of burnout in Singapore (46%), which is twice as high as for the region as a whole (23%). Yet, only half of Singaporeans (52%) are comfortable with seeking professional mental health advice, a figure that is lower than for neighbouring countries such as Indonesia (80%) and Vietnam (78%).

However, Singaporeans are generally open to advice on general health and well-being from medical professionals, with 70% saying they are comfortable seeking professional advice on these topics. Many Singaporeans also use physical exercise as a mitigating measure, with more Singaporeans (66%) linking physical exercise to improvement in mental health, compared to Japan (51%), China (55%), and Hong Kong (56%).

“The survey findings show that there are a multitude of uncertainties and anxieties about finances, health, and the future. Singaporeans are clearly mindful about their finances and looking for simplicity when purchasing insurance. At Manulife Singapore, we offer solutions that meaningfully support the aspirations and needs of Singaporeans. We also look to be a proactive health partner to Singaporeans motivating healthy habits through our home-grown behavioural insurance platform, ManulifeMOVE.,” said Darren Thompson, Chief Customer Officer and Chief Product Officer of Manulife Singapore.

-End-

About Manulife Singapore

Established in 1899, Manulife Singapore provides insurance, retirement and wealth management solutions to meet the financial needs of our customers across their various life stages. Customers can readily access our solutions through our extensive multi-channel distribution network. In addition to our established agency force, we distribute our products through a number of specialist partners, including banks and financial advisory firms.

About Manulife

Manulife Financial Corporation is a leading international financial services provider that helps people make their decisions easier and lives better. With our global headquarters in Toronto, Canada, we provide financial advice and insurance, operating as Manulife across Canada, Asia, and Europe, and primarily as John Hancock in the United States. Through Manulife Investment Management, the global brand for our global wealth and asset management segment, we serve individuals, institutions and retirement plan members worldwide. At the end of 2020, we had more than 37,000 employees, over 118,000 agents, and thousands of distribution partners, serving over 30 million customers. As of September 30, 2021, we had CAD$1.4 trillion (US$1.1 trillion) in assets under management and administration, and in the previous 12 months we made CAD$31.6 billion in payments to our customers.

Our principal operations are in Asia and Canada, and the United States, where we have served customers for more than 155 years. We trade as 'MFC' on the Toronto, New York, and the Philippine stock exchanges and under '945' in Hong Kong. Not all offerings are available in all jurisdictions. For additional information, please visit manulife.com.

[1] This version of the Manulife Asia Care Survey was conducted via online self-completed questionnaires in eight markets, namely mainland China, Hong Kong, Indonesia, Japan, Malaysia, Philippines, Singapore, and Vietnam. A total of 8,276 people, aged 25 to 60 years old, surveyed in November 2021. In Singapore, 1,000 people were surveyed. They included insurance owners and those who did not own insurance but intended to buy it.

Media contact

Zaim Zahari / Jane Goh Eveline How

AKA on behalf of Manulife Singapore Senior Manager, Communications

Manulife@aka-asia.com Eveline_KL_How@manulife.com